Medicare Direct Contracting Model and the High Needs Population

On November 25th, the Center for Medicare and Medicaid Innovation (CMMI) released a Request for Applications (RFA) for entities to participate in the “Direct Contracting Model,” to begin operations in January 2021. This is Medicare’s next iteration of accountable care organizations (ACOs), where groups of providers come together to coordinate care for an entire population and are held accountable for the total cost and quality of that care. With the new Direct Contracting (DC) Model, CMMI has included opportunities to focus on Medicare beneficiaries living with serious illness who are enrolled in original or fee-for-service (FFS) Medicare (not Medicare Advantage members).

How can Providers Participate in the Direct Contracting Model?

CMMI will contract with Direct Contracting Entities or “DCEs”, that will in turn coordinate a network of providers called “DC Participant Providers” to deliver care to a specific population of Medicare FFS beneficiaries. The Participant Providers may be clinicians, clinical practices, hospitals, hospices, home care agencies, skilled nursing facilities, and others. The DCEs will apply for participation for this demonstration project, which is expected to last for five years.

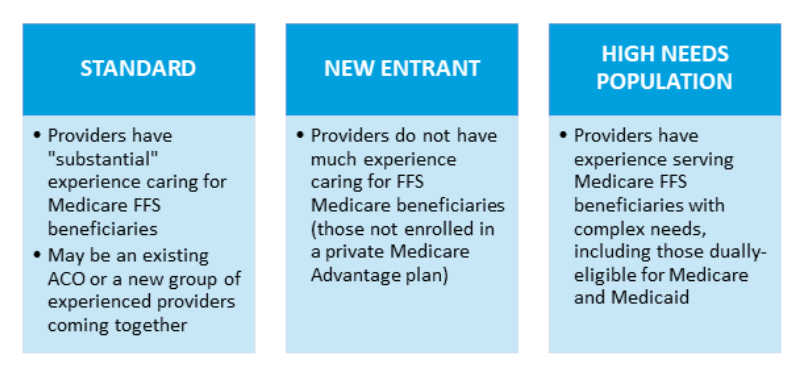

There are 3 types DCEs that can participate in the model:

For all 3 participation options, a DCE must be a “legal entity identified by a single federal taxpayer identification number (TIN) formed under applicable state, federal or tribal law, and authorized to receive, distribute, and repay monies to and from CMMI.” The DCE does not necessarily need to be a Medicare provider itself, and as noted, is anticipated to contract with other providers to care for the Medicare beneficiaries in their population.

Palliative care and hospice teams may participate as such “DC Participant Providers” by contracting with a DCE, and/or may be part of health systems that become DCEs. However, note that any palliative care practice or clinician participating in the Primary Care First models – including the Seriously Ill Population (SIP) option – cannot also participate in the Direct Contracting model.

How Do DCEs Get Paid? How Do DC Participant Providers Get Paid?

As with current ACOs, DCEs will be responsible for the total cost and quality for all of the care received by their aligned population (see more on patient alignment in the FAQ section, below). However, unlike most of the current Medicare ACOs, DCEs will assume significant financial risk for this care.

FAQ: What is "Alignment"? (Click the + to expand -->)

Medicare beneficiaries are included in a DCE by a process called “alignment.” (Note that this process is called “attribution” in other CMMI models, such as the ACO models.) These aligned beneficiaries make up the population for which a DCE is responsible for – both for their total actual spending as well as their performance on quality measures.

Beneficiaries may be aligned voluntarily or through claims. Voluntary alignment entails a beneficiary selecting a primary clinician that participates in the DCE through MyMedicare.gov or completing a paper-based form. Claims-based alignment entails CMMI reviewing Medicare claims and finding all the beneficiaries that receive a plurality of their primary care claims with a DCE-participating clinician.

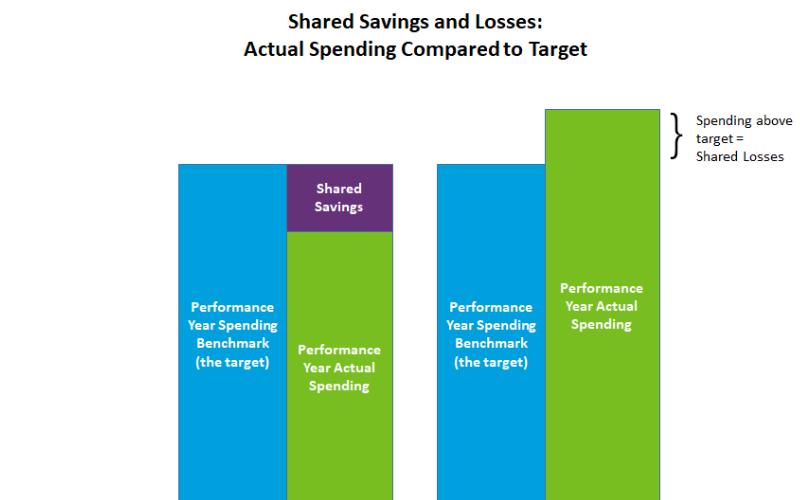

The ultimate payment to a DCE for each performance year is based on the actual Part A and Part B expenditures per aligned beneficiary compared to a target per beneficiary per month, called the “performance year benchmark.” Note that this benchmark will be risk-adjusted, but the risk-adjustment methodology has not yet been released.

Ultimate payment compares actual to target. If actual spending is less than target, some or all of that savings is shared by Medicare with the DCE. However, if actual spending is greater than benchmark, some or all of that must be paid back to Medicare by the DCE.

The share of savings and losses that the DCE is responsible for will vary based on which of the two tracks the DCE has selected:

- Professional Track: Assume 50% of the savings and losses

- Global Track: Assume 100% of the savings and losses

All three types of DCEs – Standard, New Entrant, and High Needs Population – will choose either the Professional or the Global track.

Note that the model does include risk corridors to protect providers from overwhelming losses, as well as stop-loss protection to further protect entities. (Definitions of risk corridors and stop-loss are in the CAPC Glossary of Payment Terms).

For those DCEs without a history of claims for their population and for all the High Needs Population DCEs, CMMI will set the performance year benchmark for the first 3 years based on spending in the entity’s region. The DCE service area is defined at the county level based on the physical practice location of the Participant Providers. Those counties’ regional expenditures (which are also used for Medicare Advantage premium calculations as well as some ACO calculations), as calculated in the Adjusted MA Rate Book, will serve as the target. In Years 4 and 5, CMMI will incorporate recent historical expenditures of the aligned beneficiaries in addition to the regional spending..

Payment Before Shared Savings and Losses – How DC Participant Providers Get Paid

CMMI will be paying the DCE and their providers through a monthly capitated (fixed) payment, and will later either pay a bonus or collect penalties based on actual spending compared to target (as described above). Note that there are several choices for how this capitation will be paid; for more information, please review the RFA.

These capitated payments are intended to give DCEs and DC participant providers the funds to support not only their care delivery, but also any additional services needed to optimally manage patients that might not otherwise be reimbursable, such as transportation, food, and personal care. In many ways, this is an improvement from past and current CMMI ACO models, which only allowed fee-for-service billing and then reconciled performance payments more than a year later; this long delay for shared savings has discouraged ACOs from supporting value-added services like home-based palliative care. As noted above, however, DCEs are required to take significantly more financial risk in order to receive the monthly capitation payments.

One additional highlight regarding payment: DCEs can elect to waive, in whole or in part, beneficiary cost-sharing (copays and deductibles) for Part B (professional) services, for specified categories of beneficiaries. This can eliminate financial barriers to access needed services, such as vaccination visits for immune-compromised beneficiaries or advance care planning visits for beneficiaries with specific conditions

What is a High Needs Population DCE, and Whom Will They Serve?

High Needs Population option DCEs must focus on complex, high needs people who are either dually eligible for both Medicare and Medicaid (“dual-eligibles”), or at risk of becoming dually eligible due to high health care costs which are depleting their assets. In addition to provider groups that specialize in the care of high need dual-eligibles, CMMI notes that Medicare-Medicaid plans and Fully Integrated Dual Eligible Special Needs Plans (FIDE-SNPs, which cover not only Medicare benefits but also a state’s Medicaid long-term care benefits) can also apply.

High Needs Population option DCEs must focus on complex, high needs people who are either dually eligible for both Medicare and Medicaid (“dual-eligibles”), or at risk of becoming dually eligible due to high health care costs which are depleting their assets.

High Needs DCEs must deliver care using an interdisciplinary team that coordinates all services, spanning primary care, behavioral health care, long-term services and supports, and other services. The RFA points to the Program of All-Inclusive Care for the Elderly (PACE) as an exemplar of the kind of successful model that CMMI anticipates replicating through the High Needs DCEs.

Beneficiaries to be Served Under the High Needs Population DCE

In addition to dual eligibility, beneficiary eligibility for inclusion in the High Needs DCE overlaps with beneficiary eligibility for the Seriously Ill Population (SIP) option under the new Primary Care First model; specifically patients with:

- A Hierarchical Condition Category (HCC) score (the mechanism used by Medicare to assign risk to each beneficiary) of 3.0 or greater; OR

- An HCC score of 2.0 or greater combined with 2 or more unplanned hospitalizations in the previous 12 months; OR

- DME claims for either transfer equipment or a hospital bed (as indicators of frailty).

DCEs may provide care for a specified subset of this population if they prefer, as long as it meets the criteria above and is identifiable through diagnoses in the claims data. Examples might include beneficiaries with dementia or heart failure.

Beneficiary alignment to a High Needs Population DCE may be done voluntarily by the beneficiary, through claims, or as a combination of those two. Note that the DCEs must adhere to strict marketing rules in pursuing voluntary alignment. The claims-based and voluntary alignment processes are the same for all 3 of the model options; more details on alignment can be found in the RFA.

Population Minimums

All DCEs are required to have minimum numbers of beneficiaries aligned to them. While other DCEs must have a minimum of 5,000 beneficiaries at the outset, the High Needs DCE has a lower minimum along with a “glide path” to reach the required minimum over five years:

- Performance Year 1 (PY1) – 250 beneficiaries

- PY2 – 500 beneficiaries

- PY3 – 750 beneficiaries

- PY4 – 1,200 beneficiaries

- PY5 – 1,400 beneficiaries

What are the Quality Measures and How Does Quality Performance Factor In?

As with some other recent models, CMMI has selected a short set of quality measures for all three options in the Direct Contracting Model. Four core measures will impact payment beginning in Performance Year 2, along with two new measures that will be tested in the early years of the model.

Core Measures:

- Performance on selected questions in the ACO Consumer Assessment of Healthcare Providers and Systems (ACO CAHPS)

- Advance care plan (NQF #326, the same measure used in the Primary Care First model)

- Rate of all-cause unplanned admissions for beneficiaries with multiple chronic conditions (calculated through claims, currently #38 in the ACO measure set)

- Rate of risk-standardized all-condition readmissions (calculated through claims)

New Measures:

- Gains in the Patient Activation Measure (PAM) score at 12 months

- Days spent at home, for all High Need DCEs as well as those DCEs with aligned beneficiaries’ HCC score averages of 2.0 or greater. This measure is currently under development and is also being used for the Primary Care First Seriously Ill Population model.

Performance on these measures will impact ultimate financial performance. CMMI will withhold five percent (5%) of the benchmark to use for quality incentive payments, and DCEs can earn back some or all of this withhold based on their quality score. The score considers both continuous improvement as well as sustained performance, enabling those entities who are already high-performers to earn back the withhold. In addition, a High Performance Pool, funded with the withheld funds not earned back, will be distributed as a bonus to top performers, proportionate to their number of aligned beneficiaries.

What are the “Benefits Enhancements” Included in the Model?

CMMI has the authority to waive certain Medicare payment requirements and restrictions as part of testing the model, and is anticipating allowing DCEs to elect as many as seven possible benefit enhancements. These currently include:

- Concurrent Care for Beneficiaries that Elect the Medicare Hospice Benefit.[AS1] This enhancement allows hospice-eligible beneficiaries to receive hospice care along with all other terminal disease modifying treatment, often referred-to ‘concurrent care’. The RFA notes that DCEs may contract with both hospice and non-hospice providers and suppliers (the ‘non-hospice’ not defined) to deliver hospice care, and that DCEs will need to describe how they will meet the existing hospice conditions of participation if they are not contracting with a Medicare-certified hospice. The DCE will be responsible for all costs (both hospice costs and all other services) in its shared savings/shared loss payment reconciliation. The concurrent care benefit enhancement will be available to only to DCEs that selected the Global risk track.

DCEs may contract with both hospice and non-hospice providers and suppliers (the ‘non-hospice’ not defined) to deliver hospice care, and that DCEs will need to describe how they will meet the existing hospice conditions of participation if they are not contracting with a Medicare-certified hospice.

- Waiver of the required 3-day hospital stay prior to admission to a skilled nursing facility (SNF). The participating SNF must have an overall rating of 3 or more stars and meet other requirements as specified in the RFA.

- Waiver of the direct supervision requirement for payment on both post-discharge and case management home visits made by non-billable provider personnel, such as registered nurses or social workers. This expands the ability of practices to bill for valuable interdisciplinary services delivered at home that are currently unreimbursed in the Medicare Physician Fee Schedule,

- Waiver of the home-bound requirement for home health care services. Beneficiaries must otherwise qualify for home health (i.e., have a ‘skilled’ need), not be receiving the post-discharge or case management home visits, and meet clinical criteria which CMMI will define at a later date.

What are the Opportunities for Palliative Care or Hospice Teams in the Direct Contracting Model?

The Direct Contracting Model has the potential to advance value-based care significantly, and, as we know, palliative care is a critical component of high-value care. However, given the full scope of the required DCE services and financial risk, we expect that few palliative care or hospice programs will participate as a DCE themselves, but rather may participate as part of a health system that is a DCE or as contracting as a DC Participant Provider with one or more DCEs in the area.

Palliative care teams and hospices already working within integrated health systems and ACOs should now find an opportunity to advocate for their role in the organizations’ ability to participate successfully as a DCE or a provider contracted by a DCE. Palliative care and hospice programs may also explore any opportunities to contract with DCE applicants in their area, to care for some of the seriously ill beneficiaries within their population. The CAPC Value-Based Payment Toolkit can provide guidance and resources to help palliative care programs work effectively with DCEs. One caution in contracting with DCEs: be aware of any expectations from the DCE that DC Participant Providers (such as hospices or palliative care programs) must also assume financial risk and be prepared to propose alternatives and protections (such as your own risk corridors).

One caution in contracting with DCEs: be aware of any expectations from the DCE that DC Participant Providers (such as hospices or palliative care programs) must also assume financial risk and be prepared to propose alternatives and protections (such as your own risk corridors).

In addition, some of the benefit enhancements available to DCEs—like waiving the direct supervision and homebound requirements for some home-delivered services—remove major existing barriers to payment for valuable interdisciplinary palliative care services delivered where patients live. The opportunity to deliver hospice care concurrently with all other Medicare services could be of particular interest and value to both DCEs and palliative care and hospice teams. The costs of concurrent hospice care will be included in the cost performance calculations for DCEs so this benefit enhancement will need to be engaged thoughtfully.

In Conclusion

In sum, the operations of the Direct Contracting Model are variable and complex, so those organizations interested in participating must educate themselves fully on the requirements, the options, and the financial risks. CMMI required interested organizations to submit their (non-binding) letter of intent to apply for the model by December 10, with full applications now currently being accepted through February 25, 2020. However, note that applications to directly participate in the SIP model are due January 22, 2020, and that organizations cannot participate as direct contractors in both models.

More information can be found on the CMMI Direct Contract Model webpages.